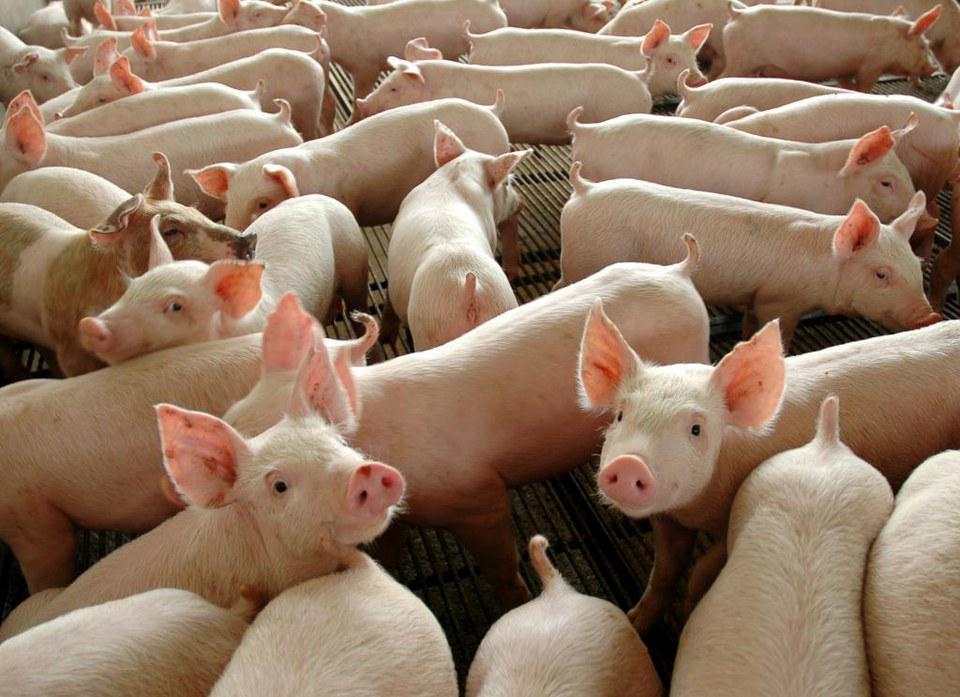

The year 2024 will remain challenging for European pig farming. Some factors accelerated the reduction in pork production in the bloc over the last few years, such as African swine fever in Eastern Europe and Germany; high costs due to crop failures and rising energy prices; and strict standards and regulations around animal welfare and the environment, which also affects costs.

According to the US Department of Agriculture (USDA), the European Union production is expected to reach 20.700 mln tons in 2024, as stated in the report released in January, referring to the global market. It represents a decline of 0.72% compared to 20.850 mln tons last year. However, the bloc’s production has already fallen by 12.34% from the 23.620 mln tons registered in 2021. Given the level of production, the trend is for pork prices to continue at high levels, which ends up affecting the attractiveness for consumption in the domestic market and exports. This is a factor that should favor Brazil in the international market, as it will have record production and affordable prices. The USA will also increase its exports and gain share in the global market, so much so that it will become the largest global exporter of pork in 2024, albeit by a small margin, if the USDA’s projections are confirmed.

According to the Department’s projection, the European Union should export 3.100 mln tons this year, with the same number expected for 2023. The USA, on the other hand, should export 3.116 mln tons in 2024. Europe has been losing considerable space in negotiations, so much so that in 2020, 5.18 mln tons were shipped, with the reduction already reaching 40.1%. Meanwhile, Brazil, even with a lower level of sales to China, must set a new export record in 2024, with SAFRAS & Mercado estimates at 1.252 mln tons, against 1.198 mln tons last year.

It is worth noting that even with the highest prices for live pigs in the bloc, there is no great incentive for local producers to boost production due to compliance with regulations, which ends up resulting in higher costs within the property. Furthermore, high prices lead to lower consumption. If demand does not increase both internally and externally, there is no need for expansion. Prices should stabilize at high levels compared to other markets, and production should balance at lower levels compared to the last decade.

Other numbers that draw attention are the total pig herd and matrices, at the lowest levels since the beginning of the USDA historical series in 1999. USDA projects the European Union pig herd at 130.8 mln head, down 2.30% from the 133.875 mln head at the end of last year. For the herd of matrices, in the initial position of 2024, USDA indicated 10.150 mln head against 10.400 mln head registered in the same period last year.