Porto Alegre, January 11, 2024 – On the 12, the US Department of Agriculture (USDA) will release a report on the meat sector at a global level, which should bring revisions to the 2024 estimates. Data from China deserve great attention, especially for Brazil, given the prospect of a challenging scenario ahead.

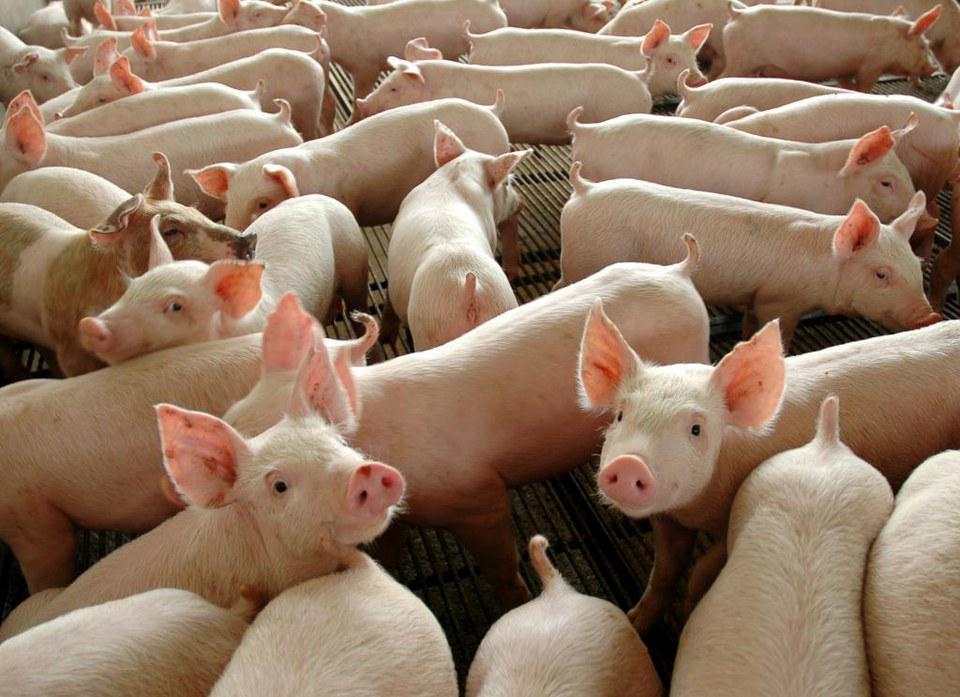

Chinese pig farming is going through a severe crisis, with increasing losses, due to the large volume of local supply. Logically, the Asian country will not get out of this situation quickly, considering that there is also a slowdown in economic activity, impacting household consumption. However, the USDA numbers can give clues as to when the market and local prices will turn around, which could subsequently stimulate Chinese imports.

USDA may revise downward the data on pork consumption in China and, as a result, import figures could be negatively impacted. Pork supply must remain at a high level in the first half of 2024, considering the strong increase in slaughter that has occurred over the last few months, with many pig farmers, especially the smaller ones, avoiding losses. Recently, China’s Ministry of Agriculture and Rural Affairs announced that in November 2023 the country’s pig slaughter grew 44.6% compared to the same month in 2022, totaling 32.8 mln head. Last October, USDA estimated China’s 2024 production at 55.95 mln tons, down from 56.5 mln tons last year, in any case, it is the second-highest production since 2016. For consumption, the estimate was 58.14 mln tons, a number that could decline, as household confidence is negatively impacted due to the level of indebtedness and default, with the deepening of the crisis in the real estate sector. The Chinese government has been adopting economic stimulus measures, such as expanding credit lines, but practical effects may take a while to work through. In mid-February, the Lunar New Year will take place in China, an extended holiday, which historically has great consumption, but will not be able to reduce supply to levels that allow consistent price highs in the first half of the year.

Live pig futures contracts traded in Dalian have been in a strong downward trend. However, considering the futures reading, market agents observe a more favorable scenario for prices from July this year. The March contract closed last Wednesday (3) quoted at 13,765 yuan per ton. The November contract closed at 17,095 yuan per ton, up 24% from the March position. Recovered prices and a possibly more valued yuan, close to 7 per dollar, could lead China to import more pork in 2025. In 2024, Chinese imports remained timid compared to the numbers from 2020 and 2021. In the latest estimate from USDA, the country’s 2024 imports hit 2.3 mln tons.

In the first half of 2024, at the worst moment for Brazilian pig farming, imports from China will not advance, and ton prices tend to continue sliding, bad for the industries’ margin, a variable that impacts live pig trading in the interior of the country. With bad prices in its market, China must keep bargaining on prices. Therefore, pig farming must pay attention to production and try to expand sales to other destinations, which is possible, since Brazilian pork will be quite competitive in the international market, especially in the European Union, where prices are high due to tight supply conditions.

Follow the Safras Agency on our website. Also follow us on our Instagram and Twitter and stay on top of the main agribusiness news!

Copyright 2023 – Grupo CMA