Porto Alegre, March 11th, 2025 – The Brazilian market had a week marked by great volatility in price drivers, in a period shortened by national holidays. The beginning of the week registered sharp lows on the CBOT, with soybean futures trading below USD 10.00 per bushel, pressured by the increase in net short positions of funds. Until last Wednesday, there was practically no movement on the physical market due to the holidays.

When business resumed on Wednesday, there was a strong trading movement, accompanied by a buying momentum on the CBOT, with contracts sharply rising. Besides, premiums reached levels of 60/70 points for FOB buyers. On the other hand, justifying the increase in premiums, the dollar plummeted.

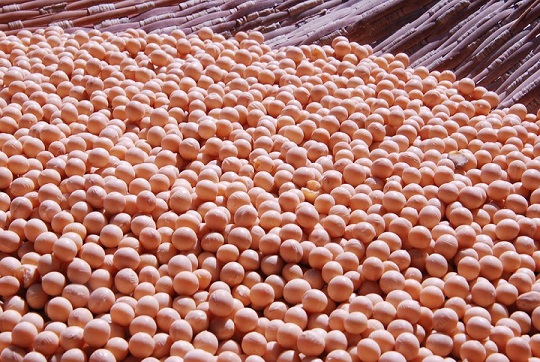

In terms of value, there were no major changes, and physical prices remain firm, providing good opportunities and fostering business. However, the current scenario still reflects a distortion, as shipments are significantly delayed, and there are logistical difficulties in obtaining trucks and transporting soybeans. Cumulative exports hit around 7.5 mln tons, compared to 9.5 mln in February last year. However, considering the size of the crop and the cargoes rescheduled for March, the real gap is between 4 and 5 mln tons in comparison to the volume that could and should be being shipped.

In this scenario, what has sustained prices are mainly premiums. This is not a structural supply problem, but rather logistical issues. With strong demand and difficulties in delivering soybeans to the Chinese market, physical prices remain strong and distorted, generating good business opportunities for growers.

Another relevant factor was the retaliation by China, which imposed tariffs on products coming from the United States. This reduces the competitiveness of US soybeans and encourages even more robust purchases of Brazilian products. However, this movement has a negative bias for the CBOT, as a possible decline in US exports implies higher ending stocks. Therefore, even with a possible reduction in planted area for the 2025/26 season, US production may remain at or even exceed the 2024 levels.

The CBOT should remain under pressure, and in Brazil there is no reason why prices should not fall sharply in the first half of the year. This movement is likely to occur as the flow of shipments adjusts. According to the line-up, 15.4 mln tons are scheduled for March. If this volume is reached, the flow will return to normal, significantly reducing premiums. It is worth remembering that, in the current scenario, there are much more soybeans available and prices at least BRL 20.00 above those registered last year, when the projected supply was much lower.

Safras News